Singaporeans were looking forward to hear the speech of the Finance Minister Tharman Shanmugaratnam about the 2015 budget. As expected, he highlighted the Silver Support Scheme and the improvement of Central Provident Fund (CPF) System.

However, many Singaporeans were surprised to hear other budget allocations. The budget allocations will directly affect the citizens. Whether it is good or bad for the other, we have to know some highlights. Here are some highlights:

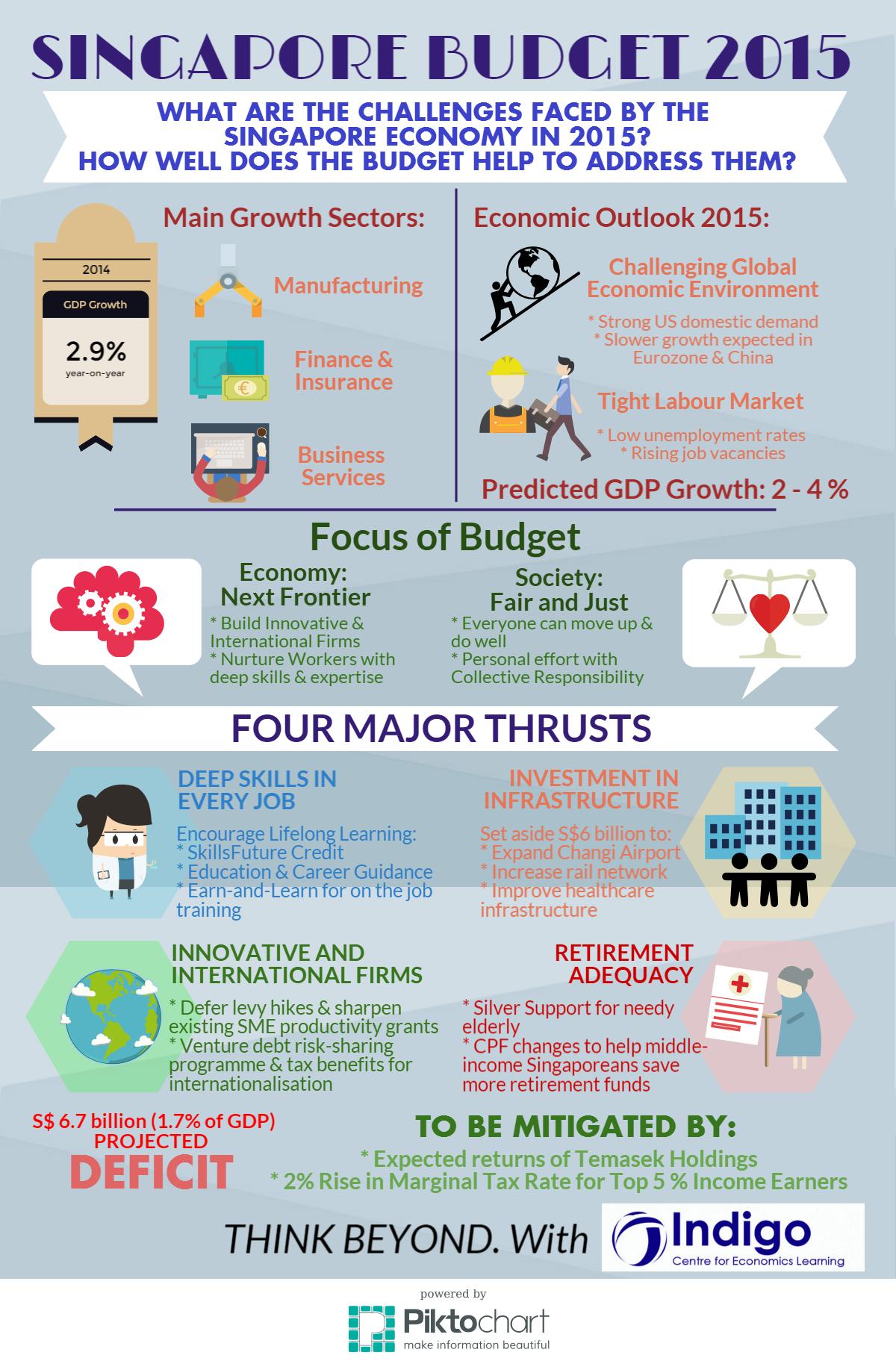

- High-income earners: The Minister stressed that high-income earners (those who make at least $160,000) will have to pay higher income tax. The marginal rate now is 20%. Come 2016, high-income earners will have to pay additional 2% making it 22%.

- Car owners: There will be additional petrol duty rates for car owners. This is effective immediately. The premium grade petrol will increase to $0.20 per litre while intermediate grade petrol will increase to $0.15 per litre.

- Middle-income and low-income households: This year’s budget benefits the middle-income and low-income households. Middle-income taxpayers can enjoy 50% of tax rebate. As for the lower-income households, the GST Voucher will be intensified to $50 cash.

- Families with children: The minister also gave importance to the families with children saying that there is a new partner operator scheme that will complement to the already available operator scheme. The parents will be happy to know that these centres will offer lower fees. The government will also augment the Child Development Accounts of Singaporean children with ages six and below. These children will receive $600.

- SMEs: To encourage SMEs and other start-up businesses, the Minister declared that the National Research Fund will be increased to $1 billion.